RLE currents Vol. 8, No. 2 (Fall 1996)

![]()

Charles M. Vest, MIT President (Photo by Donna Coveney)

This issue of RLE currents is a celebration and a demonstration of the broad social return derived from investing in advanced education and research-a return in the form of new knowledge, technologies, jobs, and a better quality of life.

Research in science and technology has generated profound advances in virtually every facet of modern life: communications, health care, the manufacturing industries and financial services, military security, housing, transportation, energy generation, environmental protection, agriculture, entertainment, and the management of government and industry. It will be even more critical in the future, where we can already picture the benefits of gene therapy, artificial organs, microscopic machinery, intelligent software, wireless networks, sustainable agriculture, and more.

The profiles of the RLE alumni in these pages are testimony to the wisdom of making such an investment. In a sense, each is a case study of how bringing together faculty and students from many disciplines creates an intellectual ferment that sparks both innovation and entrepreneurship.

Jerry Wiesner once referred to RLE as a "unique scientific incubator ... which ... has provided an almost ideal research environment and has been a model for the structure of other research centers." From its well-focused origin as the MIT Radiation Laboratory, RLE has moved with the times, or, more accurately, it has moved ahead of the times.

What has made it so special? The laboratory itself puts it this way: "The constant tension between individual focus and intergroup collaborations leads to highly specialized strengths and collective efforts that arise from the mutual interest of many investigators, The focus is on basic understanding, and the development of intellectual means to model increasingly complex phenomena. In this way, a foundation is established for building new high-performance technologies while constantly exploiting these technologies to further research progress."

Today, this broad mission and operating philosophy is expressed in work performed by sixteen distinct research groups in RLE, ranging from such fields as materials and fabrication and quantum-effect and optical devices to speech, sensory, and optical communication; and from advanced television and signal processing to radio astronomy.

This practice of bringing together people from many fields to work on problems of common interest, and of combining advanced education and research, is something uniquely American. It defines the research university as we know it. RLE has been a prime example of this for the past fifty years. It is a vital learning community in which senior scholars advance our understanding and introduce fresh, innovative young minds into the creation of knowledge-thereby educating the next generation of scientists and engineers. This system has made higher education in this country the primary wellspring of the ideas and people that are the source of innovation in a growing array of industries.

Indeed, several econometric studies conducted over the past few years have concluded that at least half the economic growth in this country since World War II has been due to technological innovation, and that the lion's share of that innovation has come from research universities. Of course, universities have not done this alone. Universities are part of a national innovation system that includes industry and government as well. Working in at least a loosely coupled manner, these institutions have created a system that produces new scientific and technological knowledge, recognizes its relevance to public and commercial good, translates some of it into industrial practice, and prepares people to develop, implement, and market it.

One could argue that the return on investment in research is even higher than 50 percent.

Take Project Whirlwind, for example, which led to the development of the magnetic core memory. The federal government sponsored this research at MIT as part of an effort to strengthen the national air defense system. Not only did it succeed in meeting its original goals, but this work also stimulated the rapid growth of this country's computer industry. This was accomplished by licensing MIT's patents on magnetic core memories to existing companies, which thrived on this new technology; by forming new companies based on the Whirlwind technology, such as the Digital Equipment Corporation; and by demonstrating the effectiveness of related technologies such as computer-aided design and numerically controlled tools, which have become big businesses in their own right.

To cite a more general case, it has been estimated that, over the last three decades, the Department of Defense alone has funded university research in information technology to the tune of $5 billion. These university programs have produced one-third to one-half of the major breakthroughs in computer and communications companies. Today, these businesses account for $500 billion of this country's gross domestic product. By any measure, that is an extraordinary return on the investment in higher education and research.

Another measure of the return on investment in university-based research is jobs. A 1989 study by the Bank of Boston found that MIT graduates and faculty had established more than 600 companies in Massachusetts. These companies, with annual sales of $40 billion, created jobs for more than 300,000 people in the state. Similarly, the Chase Manhattan Bank identified 225 companies in Silicon Valley that were founded by MIT students, alumni, and faculty. These companies recorded revenues of more than $22 billion, accounting for more than 150,000 jobs. The Bank of Boston is currently updating its study, and I am confident that when it is released this fall, the record of our contributions to the economy will be even stronger. And this is just MIT. Similar stories can be told by public and private universities across the country.

How did this stimulus to the economy come about? Through people. When we talk about technology transfer, we are talking about people: the faculty, researchers, and students who conduct research and carry their skills and knowledge to other universities, to positions in government, and to industry. As John Armstrong, IBM's former vice president for research, has said, "The best vehicle for technology transfer is the moving van." These are the stories that you will read about in the pages that follow.

While people are the key to generating and transferring scientific and technical knowledge, we need to remember that none of this can happen without the proper setting and support. I would suggest that the following conditions come quite close to what faculty members believe enables them to do their best work:

The Research Laboratory of Electronics has been fortunate that the sponsor of its core research program-the Joint Services Electronics Program-has provided this kind of support over the past fifty years. The continuity, flexibility, and understanding demonstrated by this support has made JSEP one of the longest-running research programs in the world. Its substantial achievements are directly attributable to the generosity and perception of its sponsors.

RLE's philosophy and the environment that continuous federal funding has created have paid enormous societal benefits. One measure of this has been the establishment of more than 75 companies by MIT students and staff associated with RLE, including those mentioned in this issue. Others include Bose, Teknekron, EG&G, ThermoElectron, Qualcomm, International Data Group, Meditech, and Lotus Development. An examination of these and other RLE-associated companies shows that not only has federal investment in university research and advanced education launched numerous companies, but it also has launched new industries, and has created ranges of new technologies for both defense and civilian applications.

Despite the demonstrated value of maintaining a strong, certain, and consistent investment in science and technology, however, there has been a major change in the role of the federal government in research and development. This has been driven in large measure by shifting priorities brought about by the end of the Cold War, the challenges of international economic competition, and the decision to balance the federal budget. Federal support of university research has remained rather strong this year, and there is considerable goodwill in Congress. Indeed, the budget process during the last cycle sustained the government's support for science. Nonetheless, the long-term prospects for civilian research and development do not bode well. Under both congressional and administration budget proposals, reductions of approximately 20 percent for civilian research and development are predicted by 2002.

To put this in context, the federal government currently devotes only 2 or 3 percent of its outlays to real scientific and engineering research and development. What worries me is that just as our national investment in research and development appears to be decreasing, other countries, particularly in Asia, are increasing their investments in R&D.

Now, I recognize that the federal government faces daunting budgetary pressures, and their proper resolution concerns us all as citizens, but we need to ask ourselves: Is the excellence of our human and intellectual capital growing rapidly enough? What will be the source of innovation for our industries if the wellspring runs dry?

Despite the pressures to reduce such funding, it is my firm belief that the federal government will need to remain the primary sponsor of research and graduate education in science and engineering in this country. Clearly, the times are changing and we must be open-minded about the changes in the system that need to occur. We in the universities must improve our own educational and cost effectiveness, and we need to establish new and better connections with industry as well.

Indeed, I believe that new kinds of partnerships hold the key to renewing our national investment in research and education. To ensure that our investment in science and technology, and in people, remains strong and productive, we must work together to identify new directions for research and create new settings and styles of education. In establishing such partnerships, we would do well to talk with and learn from the many RLE alumni who know what it means to start new ventures and make them grow.

by Charles M. Vest, MIT President

Jonathan Allen, Director, Research Laboratory of Electronics

In this issue of currents, we continue to profile RLE alumni who have formed significant companies that have introduced new technologies and products while bolstering the economy.

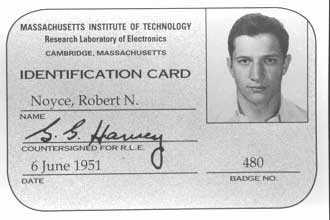

For one alumnus, we have departed from our usual format. Robert Noyce (PhD’53), who went on to co-invent the integrated circuit and to cofound Intel, died suddenly in June 1990. Since he was such a prominent contributor to the electronics industry, we present a summary of his life and two interviews with those close to him. Pendred Noyce, one of Bob’s four children, provides a deeply personal account of her father; while Gordon Moore, chairman of Intel, recounts the evolution of their joint careers. I hope you find this to be a fitting tribute.

On another note, as we look ahead to our 50th anniversary celebration on November 1 and 2, all of us at RLE are working hard to bring together a banner occasion.

Waiting for you on Friday afternoon will be a well-organized set of lab tours and a poster session. A gala evening reception will herald the opening of a special RLE exhibit in MIT’s Compton Gallery.

On Saturday, a reunion breakfast at the MIT Faculty Club will be followed by six talks presented by RLE’s faculty at MIT’s new Tang Center. These talks will be geared for general audiences, and will demonstrate some of RLE’s cutting-edge research. Two plenary talks will follow lunch, one by MIT President Charles Vest, and the second by science author and television series host James Burke. All of this will be capped by a lively dinner party on Saturday evening.

For more details on each event, please turn to page 30. It promises to be a great time; fifty years is a very special milestone, and we’re giving it our all! Please join us—we’ll be delighted to see you.

![]()

![]()

Alumnus Tribute: Robert N. Noyce

Fresh from Grinnell College in Iowa, Bob Noyce enrolled in MIT in the fall of 1949. He

anticipated continuing his studies on the transistor, a newly discovered device that he

had been fortunate enough to work with while an undergraduate at Grinnell. His physics

professor at Grinnell, Grant O. Gale, had acquired two of the first transistors from a

colleague at AT&T, co-inventor John Bardeen.

To Bob Noyce's disappointment, studies on the transistor had not yet begun by the time he arrived at MIT. Instead, he worked with Professor Wayne B. Nottingham's Physical Electronics Group in RLE on cathodes and electronic circuits. His doctoral dissertation was titled Photoelectronic Study of Surface States on Insulators, and he received his PhD in 1953.

His professional career began at Philco Corporation as a research engineer. He then joined Shockley Semiconductor Laboratory. As a member of the "Fairchild Eight," he left Shockley to cofound Fairchild Semiconductor, where he served as research director. In 1959, he became vice president and general manager, and then group vice president of Fairchild Camera & Instrument from 1965 to 1968.

Along with Texas Instruments' Jack Kilby, he was named co-inventor of the integrated circuit in 1959. Coincidentally, the two scientists had been working independently to find answers to similar problems with transistors and diodes. Bob's solution, based on colleague Jean Hoerni's planar transistor device, enabled microchips to be easily mass produced. Ultimately, Bob became the holder of sixteen patents for semiconductor devices, methods, and structures.

In 1968, he and colleague Gordon E. Moore cofounded N.M. Electronics, which later was renamed Intel Corporation. Bob served as Intel's president and chairman from 1968 to 1975. In order to focus his efforts on issues in the semiconductor industry, Bob stepped down as Intel's president. He continued to serve as vice chairman until 1979.

With four other colleagues, Bob established the Semiconductor Industry Association in 1979. He left Intel in 1988 to become CEO of SEMATECH, a consortium of fourteen American electronics companies working with DARPA to maintain competitiveness in global semiconductor markets.

During the 1970s and 1980s, he renewed his ties with MIT by serving as a member of the San Francisco Area Council, and on the visiting committee of the Department of Electrical Engineering and Computer Science. He was also a life member of the Sustaining Fellows Program and a regional chairman for MIT's Campaign for the Future.

On June 3, 1990, Bob Noyce suffered a fatal heart attack. Earlier that year, with the conviction that his goals at SEMATECH had been accomplished, he had announced plans to step down from his CEO position by year's end. His daughter Penny Noyce said, "my father told me that he planned to live past ninety. I only wish that he had. I think he crammed ninety years worth of living into sixty-two."

RLE currents presents these interviews with Dr. Gordon Moore and Dr. Penny Noyce as a tribute to the late Dr. Robert N. Noyce (PhD'53), a dedicated entrepreneur and scientist whose innovative companies and inventions have touched all our lives.

![]()

Pendred E. Noyce is the second of Robert N. Noyce's and Elizabeth Bottomley Noyce's four children. Born in Abington, Pennsylvania, in 1955, while her father was starting his career at Philco, she went on to graduate from the Stanford School of Medicine. Currently, Dr. Noyce is a staff internist at the Boston Neighborhood Health Center.

An advocate for improved mathematics and science education, Dr. Noyce works with Ann Bowers, her late father's second wife, to oversee the Robert N. Noyce Foundation. Among other programs, the foundation supports Project 2061, a long-term initiative of the American Association for the Advancement of Science that seeks to reform K-12 education in science, mathematics, and technology. She is also active in Partnerships Advancing Learning of Mathematics and Science, a statewide program of the Massachusetts Department of Education and the National Science Foundation. Dr. Noyce also works with her mother, philanthropist Elizabeth Bottomley Noyce, in her efforts to fund charitable organizations in Maine.

Dr. Noyce serves on the board of overseers at Boston's Museum of Science, on the editorial board of theJournal of Science Education and Technology, and on the advisory board of Summerbridge Cambridge.

Memories . . . My most vivid memories are family vacations. I remember my father spending so much time preparing us kids to ski with those double-layered leather boots. When we fell off the ski lift, he'd pick us up and dust us off every time. On one vacation, when we took ice skating lessons, he'd watch us kids and then do leaps around the rink. He'd fall occasionally, but he made great progress because of his gutsiness. He'd say that you can do 90 percent of a task in 50 percent of the time; it's the last 10 percent that takes time. In those activities where he was willing to be an amateur, he'd go ahead to get to that 90-percent level.

He played hard and plunged into everything he did. Whenever he saw a musical instrument he hadn't seen before, he would try to play it. One time, he hit a home run in a father-son softball game and everybody got on him, telling him that fathers weren't supposed to hit home runs.

When we moved to California, there were mustard fields behind our house with apricot orchards all around. Of course, that changed during the time we lived there. By the time I was an adolescent, I remarked on this change and was told that it was my father's fault. I didn't understand what that meant then. Certainly, though, being in a place that was undergoing rapid economic growth is part of what I remember.

At home, my father spent lots of time in our basement fiddling with stuff. When we lived in Los Altos, he led a small madrigal group. Whenever they met at our house, we'd go to sleep with songs and music coming from the living room.

He had badge number eight at Fairchild, and I knew that meant he was important and one of the bosses. The story was that he was the last one who broke off from Shockley, and that's why his badge number was eight. I don't know if it's true, but that's what I understood.

Roger Boravoy, a patent attorney at Fairchild, and his family were our friends. Once, they came over to our house, and he asked his two-year-old daughter, "What did Bob Noyce invent?" She said, "An integrated circuit." I was seven or eight at the time, and I didn't know that until she piped up and said it. My father was modest and he didn't talk much about it at home.

As Fairchild grew, many people whom my father had started it with went off to start their own companies. In his words, they were the "Fairchildren," and he was one of the last to go. Eventually, my father became discontented with the fact that Fairchild Semiconductor was doing better than any other division, and it was asked to carry the rest of the company.

By the time he started Intel, I was thirteen and I understood more. At home, when he talked about starting Intel, he said that he was going to hire only perfect people. We teased him and said, "Don't you already have only perfect people at Fairchild?"

Lessons . . . We would complain about our wages for chores and he'd say that we had to work hard to make money. He also made it clear that education was important and that we were expected to do our best. He made bets with us about our report cards before he opened them. Once, he gave me a hard time for getting an A- or B+. I said, "I bet you didn't get all A's." He pulled out all his report cards going back to second grade, and he did get all A's. Other than that, he wanted us to do whatever interested us. There was no push to do a particular thing. Initiative and adventure were important.

Mentors . . . My father talked about many intellectual areas, and he was interested in what people had to say, but he didn't talk much about himself or the influences on his life. He did have a lot of respect for his father. Part of that respect had to do with his father being an intellectual and a leader in a small community. He was also very close to Gordon Moore, since they were partners for such a long time; and Grant Gale, his professor at Grinnell College.

The wife of my father's PhD advisor at MIT recently sent me a note that my father had written while he was at Fairchild. The note told his former advisor that he was still a mentor because of the integrity of the work that had been done in the advisor's lab. What especially struck me was my father's reference to integrity as the thing he took away.

MIT . . . I get the impression he wasn't terribly proud of his doctoral work. He didn't think it was his best work and it probably wasn't the area he was most interested in. When I visited Grant Gale after my father's death, he showed me a letter from one of my father's MIT advisors. Grant had written to MIT asking how his old student Bob Noyce was doing, and if he had been adequately prepared. There was a sense that my father had gone off to the big city and Grant, his old professor, wanted to know if he was doing all right. The MIT professor responded that my father was doing well, but it must be disappointing to him because they didn't have transistors, which they had in Iowa.

Contributions . . . Clearly, the impact of integrated circuits on what we do every day is huge. I think my father felt lucky to be in the right place at the right time and to also be studying the right thing. Someone else probably would have come along and it would have happened anyway, but he was there at a pivotal time. The time was right and Jack Kilby's invention was 85 percent of the way there. I met Jack at my father's memorial service in Texas. I think they respected each other. There was a dispute at one time because Jack was named as the inventor of the integrated circuit. Sometimes my father would talk about it, but there was never any animosity. It was just something the lawyers were doing and something he was strongly invested in personally.

I think more about my father's contributions in terms of building an environment and an attitude for people and the company. My father contributed to the idea that business is a meritocracy, and everybody is free to contribute as much as they can. Nobody had a reserved parking place or a huge corporate office with a mahogany desk bigger than anyone else's. It wasn't about the power of position; it was about the power of ideas.

Motivation . . .I've spent much time trying to figure out what made him a leader, besides his talents. He didn't mind working on a team as long as he could have his freedom of movement, but I can't think of any group he belonged to where he wasn't the leader. It wasn't that he was domineering or dominating, it was simply that he was dominant and people paid attention to what he said. He had great intellectual power, but he never made other people feel that they didn't have it. It was never one-upsmanship. People liked to be around him because of his optimism and openness. He believed in competition without animosity or suspicion.

He always liked starting something new. One thing he said when he started Intel was that Fairchild had gotten too big. I think after a while Intel got too big for him too. He didn't really want it to stay small, but that's when it was most exciting.

He also liked risk and things that were on the edge. Just look at the sports he liked-skiing, flying, scuba diving, and hang gliding. He could have been a pioneer at any time in history. He would have been somebody who went to the frontier because he liked to live at the edge where innovation and individual effort are required.

He liked to look at something formulated into a problem and then figure out an approach. Within that, there were the elements of play and of building things. I think he felt more comfortable solving technical problems than human problems. Although he liked people and being a leader, he didn't like interpersonal conflict. He was graceful about nurturing the strengths of those who worked with him. Someone once told me that when they first started at Intel, they submitted a report and it came back with a handwritten note from my father saying it was good work. This person didn't expect someone on my father's level to respond personally. It was about empowering other people. There was something essentially nonenvious about my father that enabled him to do that.

He had a profound impact on many people. Usually, it was something he said to them along the lines of, "You can do it." One of his friends became interested in a harpsichord that my father had built. He encouraged his friend, and that man has been building harpsichords ever since! My father had an authority when he told someone "You can do this," and they would believe him.

Education . . . Shortly before he died, my father spoke at a Junior Achievement national convention. He talked about the values he grew up with-work hard, save your money, and get an education. He was impatient with middle-class families who said they didn't have enough money to send their kids to college. He thought it was irresponsible and poor planning. He said when he was growing up during the Depression, they didn't always have shoes, but his parents were always putting aside money for college. Well, college at that time didn't cost as much as it does now, and he did get scholarships at Grinnell, which he was always grateful for. He believed education was the most important thing because it provided people with the opportunity to take initiative in their lives.

All of his activities were at the higher education level, until he heard Bruce Albert of the National Academy of Sciences talk about the K-12 system. This was a couple of years before he died, and he became concerned about it. He talked to his wife Ann Bowers about what he could do after he left Sematech, which he had planned to do the spring before his death.

Today, the Noyce Foundation, which was set up in his will, is focused on K-12. Ann is trying to make sure things are being done the way he would have liked them. It's been interesting trying to make the foundation reflect his values when it wasn't something we actually talked about.

Etc. . . . I think my father would like to be remembered as somebody who had much joy in life; who made a contribution and inspired others. He didn't talk a lot about MIT. I know more about Grinnell, and he was more closely linked there than to MIT. However, he did endow a nontenured professorship at MIT, and a while ago I spent a day talking to various people there. My reflections from having been at MIT are that all the buildings are like a huge basement inside, and my father was always very happy experimenting with his stuff in the basement.

![]()

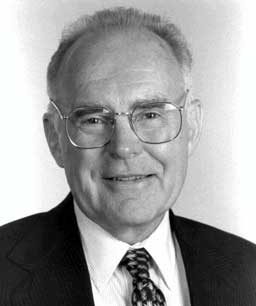

Gordon E. Moore

Chairman, Intel Corporation

Gordon E. Moore, a graduate of the University of California at Berkeley (BS'50) and Caltech (PhD'54), conducted basic research in chemical physics at Johns Hopkins' Applied Physics Laboratory before joining Shockley Semiconductor Laboratory in Palo Alto, in 1956. Subsequently, he became part of the notorious "Fairchild Eight," a group of Shockley employees who left to establish Fairchild Semiconductor in 1957. He served as Fairchild's manager of engineering and then director of R&D, as it became the first company to commercially produce integrated circuits.

In 1965, Dr. Moore wrote an article for Electronics, in which he predicted the power of integrated circuits would double every year with proportionate reductions in cost. The prediction became known as Moore's Law, and today it is an axiom in the electronics industry.

Intel was cofounded in 1968 by Dr. Moore and Robert N. Noyce (PhD'53). Their goal was to develop semiconductor computer memory, a new technology that would replace magnetic core memory. By 1971, Intel had introduced the world's first microprocessor. Today, 75 percent of all personal computers are based on Intel's microprocessor architecture.

First Impressions . . .I was a physical chemist at Johns Hopkins University when Bill Shockley phoned me. I had wanted to return to California, where I grew up, and to do something more practical. So, this was a great opportunity. I met Bob Noyce in April of 1956. He came to work for Shockley on a Friday, and I came on the following Monday. We were staff members, and Bob became the de facto leader of our group. He met people easier than anyone I've known, and everyone liked him when they first met him. He could easily walk into any situation and be at home.

Beginnings . . .Shockley had peculiar ideas about motivating people, and there were bizarre incidents, so we tried to insulate him from any management role. We even asked Arnold Beckman, who had financed the organization, to get Shockley appointed at Stanford or involved in consulting. We were making great progress until someone told Beckman it would ruin Shockley's career, so he changed his mind. He said Shockley was the boss, take it or leave it. We decided that we had burned our bridges so badly that we all had to look for new jobs.

Initially, there were seven of us. Someone in our group wrote to his father's friend at an investment banking firm, asking if he knew of a company that would hire the whole gang. When one of the firm's senior partners and Arthur Rock visited us, someone in our group talked Bob into coming along. The investment bankers told us that we should set up our own company, and they would find us the financial support. We contacted about thirty-five companies on the New York Stock Exchange that might have wanted a semiconductor operation. They all turned us down without even talking to us. Then, the bankers accidentally ran into Sherman Fairchild, and the management at Fairchild Camera and Instrument were willing to take a shot at it. That was the founding of Fairchild Semiconductor.

None of us had any business experience, so the first thing we did was hire Ed Baldwin as our boss. He had been engineering manager at Hughes Semiconductor. About a year later, he spun off another company with some of the people he brought with him. We discussed whether or not we should look for someone else because we didn't want this to happen again. So, we elected Bob as the general manager of Fairchild Semiconductor. That's when he officially became my boss.

New Directions . . . Fairchild wanted to run the company with a three-man committee and a board of directors who didn't know anything about our business. They also wanted to bring in someone from the outside, even though Bob was the logical internal candidate. Bob knew he was going to be passed over, so he decided it was time to do something else. I was director of the laboratory then, and I was frustrated too. It was becoming difficult to move new ideas from the laboratory into production. So, I thought it was a good time to go. When Bob and I decided to start a company, Andy Grove, the lab's assistant director, wanted to come along too.

Raising money for Intel was interesting. It was the heyday of venture capital, and we had our successful track record from Fairchild. Art Rock, now a San Francisco-based venture capitalist, called some friends and raised the money in an afternoon. When we started Intel, Bob was president and I was executive vice president. Bob had more of an outside focus since he had been away from the technical aspects of the business for some time. I had more of an inside focus since I was still running a laboratory. We had worked together long enough and we trusted one another.

Goals . . . With Intel, we saw an opportunity to change the leverage in the semiconductor business. It was difficult to define a complex product that could be made in large volume since everything tended to become unique above the individual gate level. The industry was at a point where low-cost assembly in southeast Asia was a competitive advantage.

We saw an opportunity to develop new technologies oriented to making semiconductor memories; specifically a product that could be made in complex blocks and sold for various applications. By doing that, we thought we could compete with established companies by putting cleverness back into processing silicon.

Hallmarks . . . We made some fortunate choices, such as the metallic oxide semiconductor (MOS) technology we chose to develop. We started with what I call, in looking back, our "Goldilocks strategy." We decided to develop three areas-bipolar technology, silicon gate MOS, and multichip assembly technologies, where we put several memory chips into one package. The bipolar technology worked so well that our competitors copied it right away. The multichip technology was just too hard, and we still can't do it cost effectively. But, the silicon gate MOS technology was just right.

When we focused on it, we got by a few technical problems without major difficulty, but the larger established companies got hung up on them. As a result, we had the technology to ourselves for about seven years, and we had a good chance to become established. It wasn't until 1975 that we had competition in silicon gate from the established companies. If it had been easier, we would have had competition sooner. If it had been harder, we might have run out of money before we even had our first client. But, we didn't know that when we started out.

Contributions . . . Bob's technical contributions were extremely important up through the integrated circuit invention. They were key to the growth of the industry. Another one of his contributions happened in the beginning when we had trouble selling them. Our point of contact to the customer typically had been the circuit designer. When we told the designers that we had the circuit already designed, it didn't hit a responsive chord. They had all kinds of reasons why it wouldn't be reliable. Bob told them, "We'll sell you the circuit for less than you can buy the individual components to build it yourself." That was a major step in getting integrated circuits broadly accepted, and it gave the industry a big boost. Suddenly, it was the cheapest way to do things.

Later, Bob was one of the first people to realize the impact of the Japanese push towards quality. When he returned from a trip to Japan, he gave us a fix on how their quality was much better than ours. It took a while for that to sink in, but he certainly started us thinking about it. Partly as the result of that, he was instrumental in forming the Semiconductor Industry Association, which has had a significant impact on trade-related issues. In turn, that led to his position on competitiveness, which resulted in the formation of SEMATECH. Bob was one of the driving forces in this whole competitiveness issue. He finally took on the job of running SEMATECH himself because he couldn't find anyone else suited to do it. He went from detailed technical problems, such as space-charge recombination models, to looking globally at the industry and its impact on the United States.

Management Style . . . Bob wasn't a manager, he was a leader. He always set a direction and a tone. He thought that if you suggested good ideas to people, they would naturally do the right thing. He didn't like to manage because there was always the follow up involved.

Challenges . . .Bob would never come at a problem from a conventional direction. He always had a different approach, and often it was an important one. He would come up with ideas completely out of left field. Everyone knew they wouldn't work, but you had to try them, and often the conventional wisdom was wrong. Sometimes you'd be receptive to them. Other times, things would be going so well that you didn't want to be distracted by too many wild ideas.

Once, we were trying to make contacts to our first transistors at Fairchild. I had the job of coming up with a single metal system to make contacts to both the base and the emitter. Bob asked why I didn't try aluminum. We both knew aluminum didn't make ohmic contacts to n-type silicon. Anyone who should have known that would have been Bob, with his background in device physics. But, the aluminum was easy, it worked perfectly, and it made a beautiful ohmic contact. It took five years before we actually understood why.

Another time, we had problems making diodes that had junctions with good, sharp breakdown characteristics. Occasionally we got good ones, but there was a huge variation. Someone at Bell Labs had just published an article about using nickel to increase the lifetime of silicon. Bob suggested nickel-plating the backs of the wafers before putting them in the diffusion furnace. I don't know why, but we tried it, and the junctions were as sharp as could be. Again, it took a while before we fully understood what was going on, but Bob had good intuition. He tried things that, for those of us who thought we knew something, we never would have tried ourselves.

He had clever new ideas about almost any subject. It got to a point where he spent less time at Intel and more time on outside activities. He was such an interesting guy with broad interests. He was always down to earth about everything. He became interested in dealing with Washington and was excited to be out there with the politicians. I think Bob would have liked to have been remembered as a Renaissance man, and successful in the wide variety of different ventures that he put his energy into.

Significant Achievement . . .Bob and I grew up with the integrated circuit. He came up with the idea when we were at Fairchild. Then, he was promoted and I had the job of making them. Getting out the first integrated circuits was exciting. What we've accomplished at Intel is also exciting; building the company and its products. The basic technology that we developed at Fairchild became the foundation for the industry. Certainly, it was nice to be in the right place at the right time.

![]()

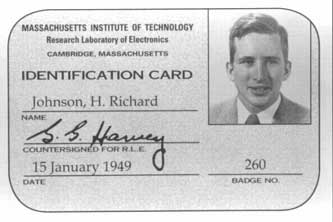

H. Richard Johnson

Vice Chairman, Watkins-Johnson Company

H. Richard Johnson (PhD'52) came to MIT in 1947 after completing his bachelor's degree at Cornell University (BEE'46). He received a four-year physics fellowship at RLE and worked in the laboratory during its formative years, from 1947 to 1952. After graduation from MIT, Dr. Johnson headed the microwave tube department at Hughes Research Laboratories, where he met Dean A. Watkins. In 1957, they established Watkins-Johnson Company (WJ) of Palo Alto, California. Originally founded as a defense electronics firm, WJ later diversified its business to semiconductor manufacturing equipment, telecommunications, electronic products, and environmental consulting services. Its product line expanded to include receiver and digital processors for intelligence collection, solid-state microwave devices and subsystems, and chemical-vapor-deposition machines for semiconductor manufacturing. Today, WJ's semiconductor equipment is used by a majority of the world's producers of microprocessor, logic, and computer memory chips. A holder of three patents and a former Stanford University lecturer, Dr. Johnson served as WJ's president and CEO until 1988.

Memories . . .When I got to MIT in 1947, I was told to look around RLE and see what I might be interested in. RLE had everything-state-of-the-art equipment, brain power, and lots of room. I became interested in Lou Smullin's group, which was working on traveling-wave tubes. After one project with him, Professor Stratton suggested it would be better for me to do something more in line with physics. I found Woody Strandberg, and he became my thesis advisor for my work on microwave spectroscopy.

Beginnings . . .Dean Watkins and I were on the technical staff at Hughes Aircraft in Culver City, California, where they were working on traveling-wave tubes. I didn't know much about them, and I became acquainted with Watkins by picking his brain on the subject. Watkins left Hughes after a year to join the faculty at Stanford, but five years later he became restless. In 1957, he asked if I would like to start a company with him. As a middle manager at Hughes, I was also restless and I thought it would be fun. We raised some money (now called venture capital) from a company in San Francisco with help from a couple of MIT graduates-Bill Hewlett ('36) and Fred Terman ('24). In the beginning, Dean Watkins was president, I was vice president, and we had about three employees. When we went public ten years later, I became CEO and Watkins became chairman of the board. We've always worked closely together and our offices have always been side by side. Today, Watkins is the chairman of the board, I'm vice chairman, and we have about 2,200 employees worldwide.

Goals . . .Traveling-wave tubes were the only things Watkins and I knew anything about. A lot of big companies like GE, Sylvania, and RCA were working on them then. We thought we could make a tube with better electrical specifications and better reliability, and we did. We wanted R&D contracts from the government so we could develop products that we could also manufacture. We also wanted to make a profit so we wouldn't disappear.

Hallmarks . . .Watkins-Johnson made state-of-the-art traveling-wave tubes that enabled spacecraft to radio signals back to Earth. Pioneer X, which flew out of our solar system some time ago, contained traveling-wave tubes that we made for its voice. So do the Voyagers I and II, and Galileo spacecrafts. These spacecraft transmit at different frequencies. Some are S-band, others are X-band, and others have both frequencies. They can measure the atmospheres in moons and other planets as the two frequencies are occluded. We also made low-noise traveling-wave tube amplifiers that are now obsolete, but when we made them, they had the world's best noise figures and the longest life. We also sold intelligence-gathering radio receiving equipment.

We now make solid-state amplifiers with state-of-the art properties, low-noise amplifiers, and mixers with high dynamic range. In addition to being the sole supplier for several parts of the Hughes and Raytheon Advanced Medium-Range Air-to-Air Missile, we make solid-state microwave components, microwave subsystems, radio receiving equipment for the intelligence community, and processing tools for the semiconductor industry. Our machines work at atmospheric pressure and can make the doped silicon dioxide dielectric coating on wafers. These machines have greater throughput than our competition's. One of our machines deposits the oxide from silane. The newer ones use tetraethyl orthosilicate, which is a low-temperature process that does a better job of coating deep grooves in small geometries. Our semiconductor processing equipment accounts for about 40 percent of our sales, and it's practically 80 percent of our profits.

In the defense business, we're one of the suppliers that still makes microwave equipment. Many of our competitors have disappeared or are not very strong. In the business of semiconductor processing equipment, our throughput is what sets us apart. Our products enable the contact dielectric to be applied to more wafers per hour than any other method.

Growth . . .When I was CEO, we perceived solid state as the wave of the future. We started working on silicon, but decided that too many people knew so much about it that we would never catch up. So, we tried a new material-gallium arsenide. A tremendous amount was accomplished by Keith Kennedy when he became our CEO in 1988. We were making chemical-vapor-deposition machines when he took over, but it wasn't a major part of our business. In his first year, the company got a little bigger and made a little more profit. Then world peace broke out and defense took a nosedive. It didn't look good for a couple of years, but then Keith got our semiconductor business fired up. Also, many of our competitors disappeared. Now, our semiconductor business is quite successful.

Issues . . .We're a defense company and the world is now a more peaceful place than it was before, so defense budgets aren't as large as they used to be. It's also difficult to be able to do something new quickly, and then have a product that works and is quickly accepted. For example, in broadening our semiconductor equipment line, we would like to make a high-density plasma coating system. With this system, we might be able to make lower dielectric and intermetallic dielectric layers, which cannot be done with our current equipment. This will be a new venture for us, and we're trying to do it fast so that when the need arises for these machines, we'll have a working piece of equipment that we can manufacture. It's a frantic process; making sure something works the way we want it to, and doing it with the people we already have so that we can afford to finish it on time. Your tool may be the greatest in the world, but if it's six months late, customers won't use it.

Corporate Culture . . .It's our policy to obtain technical staff at the beginning of their careers, when they start out from school. The top universities have the best, brightest, and most motivated young people. So, when you find a person who has graduated from one of the top schools with good grades, you have a smart person. We have quite a few MIT graduates on staff, and we're getting more all the time. When you hire an engineer who has just graduated from a top school with good grades and good references, you have someone who has an excellent chance of being productive. If you hire an experienced engineer who has had many jobs, you have an excellent chance of winding up as the top line on their resume before that person does anything useful. We do hire senior engineers when we have problems that we don't know anything about and when we don't want to reinvent the wheel. In addition, we're so small that we don't do fundamental science unless it relates to something that we can sell fairly soon. So, in that area, the new graduates bring us modern knowledge.

We don't bet the company on wild schemes. We simply move ahead slowly. We've produced mostly monotonic growth that hasn't been spectacular, but it's comfortable. We do take some risks, but not colossal ones, if we can avoid them. We have three main manufacturing sites where we also do engineering. In Palo Alto, we do defense component and subsystem production. In Scotts Valley, California, we do semiconductor R&D and production. In Gaithersburg, Maryland, we do wireless communications equipment. We've also been trying to start demonstration laboratories in Japan, South Korea, Singapore, and Belgium.

Rewards . . .It's good to see the company doing all right. It's fun to be the old man who gets credit for a lot of the good things that have happened in the company. I also enjoy my association with our employees. We have many loyal employees who appreciate working here. I don't own a large part of the company and we have a lot of employee ownership. It's a good place to work and we've helped a lot of people.

Etc. . . .I used to see Bob Noyce (PhD'53) and Gordon Moore when they started Fairchild Semiconductor in Palo Alto, in 1957. We didn't have any direct business connections because they made silicon transistors and we were in the microwave business. However, Bob and I both knew William Shockley, and he was one thing we could always talk about. Before I graduated from MIT, Shockley invited me to visit Bell Labs, where he was working at the time. He wanted me to talk about what I was doing, so I gave a talk about ketene. It wasn't my doctoral thesis, but I knew more about it than anyone.

At my talk, it was like a murderer's row with Anderson and Shockley in attendance. When I finished, no one had a question, except for Shockley. He said, "In that one microwave absorption line, you said the statistical weight was three." He drew a picture on the blackboard and said it was possible that the weight was one. I had copied the statistic from a Herzberg book, so I knew it was right. I didn't know what to say, but I told Shockley that I would think about it and write him a letter. When I returned to MIT, I got out the book, and he was right! I wrote a letter telling him I was sorry. In my paper on ketene, I even gave him credit for helping me.

Two years later, I met Shockley again at a conference in California. We were on a long line waiting for food. Shockley went to the front of the line and got a plate of food. He came through the line offering it to people; trying to proselytize them.

When he got to me, he said, "I know you. What's the connection?" When I reminded him, he said "Oh, yeah. You're the guy who didn't know a damn thing about quantum mechanics." One of my specialties at MIT had been quantum mechanics, so it was an awkward moment. Then I said, "Does your wife like it here in California?" He replied, "She didn't like it, so I had to get a new wife." I couldn't think of anything else to say. After another awkward silence, he continued down the line with his tray of food. He was smart, but he certainly was a character.

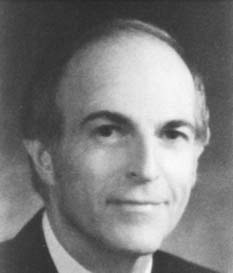

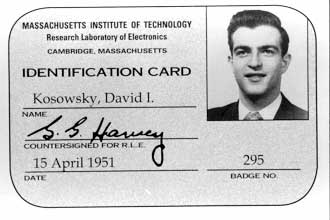

![]()

David I. Kosowsky

Chairman Emeritus, Damon Corporation

David I. Kosowsky (SM'52, ScD'55) worked in RLE as a research assistant and staff member from 1951 to 1955. In 1961, Dr. Kosowsky cofounded Damon Corporation of Needham Heights, Massachusetts, with Carl E. Hurtig, a former RLE staff member. Damon quickly diversified its original electronics business by developing new services and products in health care, medical science and instrumentation, and educational and leisure-time activities. Dr. Kosowsky served as Damon's chairman and CEO until 1989. He continues to devote much of his time to serving on the boards of many nonprofit and civic organizations in the Boston area.

Memories . . .In 1951, I came to MIT with several other City College graduates. When I applied for a research assistantship, I ended up at RLE. City College had been a good place to learn, but it didn't have the opportunities that we had at RLE. RLE was a place where innovation could flourish. There were many stimulating people and lots of exciting interaction. I was able to do what I enjoyed, just as long as it was reasonable and contributive. It didn't matter if it had a direct relationship to any current project. What was important was that it was innovative or interesting to the people around me.

Mentors . . .Jerry Wiesner was responsible for many things that have happened in my life. He was one of the most wonderful people I have ever met. In 1955, Jerry and Jerrold Zacharias formed a company called Hycon Eastern, which later changed its name to Hermes Electronics. At the time of my graduation, Jerry asked me to join Hycon. I had been offered a job at Hughes Aircraft, largely because of my thesis work in crystal filters, but I decided to join Hycon, where I started a division based on my thesis research. My business career, up to and including the formation of my own company, was based on crystal filters.

Motivation . . .Hermes went public in 1958 and merged with Itek Corporation in 1960. Itek's primary interest in Hermes was its communications work. After the merger, a division called Itek Electro-Products was created to house the Hermes Crystal Filter Division. This new operation did not fit either Itek's business interest or its corporate culture, and it did not thrive. In 1961, I formed a company called Damon Engineering with a few of my coworkers. Damon was formed to continue the work on the piezoelectric crystal products that we had started at MIT.

Beginnings . . .Damon was a small electronics company when it was formed. In 1965, we entered the education business. This business was based on Jerrold Zacharias' idea of teaching science to kids in the post-Sputnik era. We developed inexpensive apparatus that turned the classroom into a laboratory, since most elementary and secondary schools didn't have laboratories. Basically, we followed the development of new curriculum programs, working with the development groups on apparatus for their programs. Then, we approached the publishers of the new course textbooks and entered into exclusive marketing arrangements with them. At the time when Damon had its first public offering in 1967, it had about $3 million in sales from electronic and educational products.

Damon also entered the hobby business in order to provide science-oriented students with a means to purchase the apparatus that was only available to them in school. We acquired companies that marketed to school-age children, such as Estes Corporation, which manufactured model rockets. Estes was a well-known company with a very large catalog business. We did not acquire them for their model rockets, but rather to use their catalog distribution system for our scientific apparatus. Children of all ages liked the rockets, but they just weren't turned on by the science apparatus. Over time, our education business became dwarfed by the hobby business, which took off on its own.

Growth . . .In 1969, in the midst of strong growth, we began an acquisition program in medicine to further diversify our business. We acquired IEC (International Equipment Company), a laboratory centrifuge company, and used it as a vehicle to enter the clinical laboratory business. The Clinical Laboratory Act of 1967 made it possible for non-physicians to own clinical laboratories. In 1969, there were thousands of small independent clinical laboratories serving physicians and hospitals. We were the first company to acquire and consolidate clinical laboratories, taking advantage of new instrumentation that automated blood chemistry and other laboratory tests. The new automated machines required large volumes of tests in order to achieve the desired economy of scale. The consolidation and centralization of small independent laboratories made this possible. By the early 1970s, Damon laboratories had combined revenues of about $100 million, resulting from acquisitions and internal growth.

We began as an electronics company and became primarily a medical company, so it's hard to predict where you're going to go. We also formed Damon Biotech, based on a technology called microencapsulation. However, we were acquired before that technology could be fully developed.

Firsts . . .Damon formed the first, and for a while the largest, network of central laboratory facilities. Before Damon, a few central facilities served physicians by mail order. In addition, we were the first independent network to work extensively with hospitals. Damon's clinical laboratory network became its fastest growing business segment.

Parting Ways . . .Damon's aggressive acquisition program had its dangers, and we had some difficult years in the mid-1970s. We recovered in the late 1970s, with strong growth continuing into the 1980s.

In 1988, Damon was attacked by a private group supported by Drexel-Burnham-Lambert. It was the 1980s; the days of Michael Milken and junk bonds. Damon had a lot of cash and diverse shareholders, but we didn't think we would be attacked since we weren't that big. We had about $250 million in sales. We were also technology-based, and in an industry without many large players.

This was one of the toughest times of my life. Damon was a company I had founded and enjoyed running. However, there were few choices when put into play by raiders. We could have arranged a leveraged buyout, but Damon always had a lot of cash and flexibility, and I didn't want to run a leveraged company, spending my most of my time dealing with large amounts of debt. Damon could also have been bought by someone else, which is what happened a few years later when Corning acquired the Damon laboratories. In the end, we made a friendly buy-out arrangement with the raiders.

Challenges . . .The biggest challenge was dealing with a public company and all the pressures that being public creates. Stock performance is not always related to corporate performance, particularly on a short-term basis. Putting acquisitions together, making them work, and providing opportunities for former owners of acquired companies was also challenging and, at times, very rewarding.

Obstacles . . .There was some conflict between wanting to spend much of my time in science and research, and yet knowing that I couldn't or shouldn't. In the days of Damon Biotech, I often visited the laboratories at MIT's Biology Department and at local teaching hospitals. I was also interested in management, and although science was generally more interesting to me, management usually won out because that was my primary responsibility.

Success . . .For the first five years of its life, the odds are very much against the success of a new business. The primary reason for this is usually insufficient capital. Most entrepreneurs underestimate the true capital needs of a new enterprise. Another significant problem, particularly in businesses that experience rapid growth, may be the inability of the founding entrepreneur to develop the management skills needed to lead a growing business, or to recruit people to perform those functions.

As a company grows and becomes successful, management often finds it difficult to continue to do innovative or entrepreneurial things. The entrepreneurial spirit may have to be directed in different ways. While it may be impractical to continually form new companies, it is possible to enter new areas in innovative and entrepreneurial ways. Damon, for example, was heavily involved in four distinct businesses: electronics, education and hobby products, laboratory medicine, and biotechnology. To make this possible, Damon had to attract people with technical, entrepreneurial, financial, and management skills. I was gratified that we could do this, and particularly that we could meet the challenge of getting entrepreneurs to work as part of our team. By definition, entrepreneurs want to do their own thing.

Technology Transfer . . .Damon was involved in technology transfer on many levels, particularly in the biotech area, where Damon funded research at universities and hospitals, and made arrangements to sponsor the development of the results of such research. This was an interesting area because there are conflicts between the roles of industry and universities that need to be addressed and resolved.

Issues . . .Some time ago, the United States government legislated a number of entitlement programs in medicine, and now it's difficult to change them. It's clear that we are either not able or willing to continue funding these entitlements at the anticipated growth levels. In laboratory medicine, there will likely be a negative effect in terms of cuts in funding for programs like Medicaid and Medicare. All third-party payers would like to pay less. The only balance to that is economy of scale, and the question is when does that reach the point of diminishing returns?

Today, there are so many issues in medicine: aging, technology, growth without cohesiveness, third-party payments, patients not involved in their own decision making, and physicians working in all types of financial arrangements. It's such a patchwork that it's difficult to predict outcomes, but the financial constraints will certainly always be there. Healthcare financing is an enormous problem, and there are no simple solutions.

Rewards . . .My work with hospitals has been rewarding. Hospital boards can attract people from many different disciplines. One of my biggest rewards was to bring some knowledge of both health care and business to a complex activity that involved working with both physicians and laymen. On the business side, it was, of course, most rewarding to watch Damon grow.

Significant Achievement . . .Building a successful business from scratch was fun, and to the outside world it might have been my principal achievement. On the other hand, some of the technical things I did were personally more rewarding at times.

MIT has been responsible for so much in my life. It's an institution without peer. The success and contributions of its alumni, even in fields removed from their areas of specialization and training, is testimony to the fact that in the MIT environment, one learns that engineering and science has a significant responsibility to society as a whole.

![]()

Ronald A. Howard

Director, Strategic Decisions Group

Ronald A. Howard (SBEE/SBEcon.'55, SM'56, EE'57, ScD'58) cofounded Strategic Decisions Group (SDG) of Menlo Park, California. After serving as an assistant professor in RLE from 1958 to 1962, and as a member of the MIT faculty until 1965, Dr. Howard joined Stanford as professor of engineering-economic systems. As one of the founders of the decision analysis discipline, he has published many articles on probabilistic modeling and decision analysis. His three books on dynamic programming and Markov processes serve as major textbooks and references for research in these fields. Dr. Howard has used decision analysis techniques in a variety of applications-from investment planning to research strategy, and from hurricane seeding to nuclear waste isolation. Today, SDG is an international consulting firm dedicated to helping business executives, planners, and engineers improve their analysis and decision-making skills. As director of Stanford's Decision and Ethics Center, Dr. Howard also leads a program in social analysis.

Memories . . .I came to MIT as an undergraduate because of its reputation in science and engineering. This was in the early days of integrated circuits. Later, as a young assistant professor, my interests moved from electrical engineering to using technical ideas in a broader range of problems.

From 1958 to 1964, the hot topics included information theory and magnetohydrodynamics. This was before the integration of computer science and electrical engineering, and we were beginning to see the impact of computers. I was heavily involved in that research and its applications. My interest was in applying technology more broadly to systems and organizations. MIT's Operations Research Center had a connection with RLE, and I worked on system analysis there. I also taught for six years and started a probability course in electrical engineering. I wanted to make sure that people in electrical engineering studied probability and economics. Before leaving MIT, I became associate director at the Operations Research Center.

Beginnings . . .I was one of the five founders of Charles River Associates (CRA). CRA was the successor of another company that I founded with my colleagues called Systems Analysis and Research Corporation. That was an off-shoot of another company called United Research. We had left United Research to start Systems Analysis and Research. After six months, we discovered that we had differences with some of our colleagues. That's when we started CRA. In all these companies, we combined technical and economic ideas. CRA's goal was to bring high-quality economic analysis to business problems with a focus on transportation.

New Directions . . .When Bill Linvill (SB'43, SM'45, ScD'49) and I came to the West Coast from MIT, we asked, "Where's Arthur D. Little?" I had always used them as my clinical laboratory, but they weren't here, except for a small office. So, we started a joint engineering-economic systems program at Stanford Research Institute and Stanford University. Students went there on internships and had access to the latest thinking. After a few years, that became the decision analysis group. It was the first such group in industry and it served companies like Exxon, Xerox, and Morgan Guaranty. Two groups of my former doctoral students split off from that. One formed Applied Decision Analysis, and the other formed Decision Focus. Both are still going today. In 1980, three colleagues and I started Strategic Decisions Group (SDG), and today we have over 200 employees.

Goals . . .SDG's goal is to improve business decision quality for Fortune 100 companies in the United States and internationally. Most of our work involves business problems. We look into what makes a high-quality decision and how you can tell when you have made one. We're not talking about feeling good about a decision. We're talking about leaving a person with a clarity of action about what to do. That doesn't mean clarity of result, and it doesn't mean the situation will necessarily get better. It's knowing you're doing the right thing.

Conversation is what leads people to clarity of action. For example, someone who has spent a lot of money on an investment that's not working out may be tempted to throw more money at it in a futile try to save it. A brief conversation will reveal the initial investment as a sunk cost that should play no role in decisions about the future. Such conversations alone can resolve many issues.

Beyond that, the conversation may involve calculation. Ultimately, the process may also involve equations and computers. One example would be deciding which annuity to choose, but the process itself isn't about calculation. It's about conversation, which may then involve calculation. We must deal with alternatives, information, and preferences. We also must realize that we don't know the future and we must deal with uncertainty. The major factor that confuses people about what to do is uncertainty.

We also have a pro bono activity with a local organization, the Community Breast Health Project. We provide expertise to individuals who are faced with a breast cancer diagnosis and many real-life decision-making issues-psychological, family, social, economic, and technical. Stanford's Department of Psychiatry is also involved in the project. Their preliminary studies show that the difference in patients' attitude is a factor of two in results. Think about that. The scientific community wants to keep putting things in your body to see the effects. Here's something with a bigger effect that you can't write a prescription for, even though it's the best thing you can do for a patient.

Firsts . . .SDG is the first company to bring the latest, most powerful thoughts and procedures for decision making into the boardroom. There are many excellent consulting companies, and they may be able to help you just by helping you think through issues. SDG's philosophy is more fundamental. We want to leave people not just with clarity of action on a decision, but also empowered with new ways to help themselves. It may take a while to do that, and it may involve a change process, but ultimately we want them to be able to provide their own clarity of action.

Consulting companies are like universities for companies. They transfer technology because they bring in something companies don't have. Yet, they're so expensive that you don't want them around all the time. At SDG, we want to train clients to do things effectively themselves. Occasionally, they might need "brain surgery," and then they'll call us back. We're also working to extend the kind of decisions that we can help our clients with; from strategy to operations. We'd like to be able to say, "Here are the people who can make sure something happens." We can then serve them more broadly, instead of saying that they should do this, but we really can't help them with it. We always want to focus on decision making and not get diffuse.

Corporate Culture . . .We think about walking our talk and about the home in which we want to live. We think about the essence of our professional life, not just our business. Over the years, we've constructed something we call the value wheel. It's not for our clients; it's to remind ourselves what we're about. The idea is to have fun and to learn in our world of improving decision quality. We also want to treat people with dignity and respect. There's no deception, we tell the truth and we respect everybody-employees, clients, and each other. Then, we also have to be a business. We have to provide valuable services so we can hire the people we want and give them financial security.

At Stanford, I teach a course called The Ethical Analyst. We discuss a scenario in class where you're a sales rep and your company has told you not to talk about a new product that's coming out next week. Then, you meet with a customer who says, "You want me to buy your product, but I don't want it to become obsolete." What do you tell that customer? Think about it as if you were talking to a family member. If that customer was a family member, you'd tell them to wait a week. It's a problem when we have different standards for everyone.

Challenges . . .We're world class in what one might call the hard thinking about decision making. If a person or a group wants to know what's best for them, we can help them in a way that few companies could. I call that knowing the right thing to do, but the challenge is in getting things done. For example, it's easy to get people to do something that's wrong; you could get a consensus on going over a cliff. Our challenge is to get the right thing done. We're world class at knowing the right thing, and we're becoming world class at getting it done. That's our challenge, on both the human and logical sides.

Limitations . . .We use specialized software and we have to develop some of our own tools to make our work efficient. We're like a pianist who wishes Steinway could make a better piano. We can't find the right piano, so we build one in our back room. These tools bridge the gap between the soft, fuzzy world of executive thought and the hard world of a computer. When you hit the wrong key, a computer doesn't understand what you mean. We have developed powerful ways to bridge that gap better. We use representational devices called influence diagrams, but right now there's no powerful computer software to help us design them. We could develop software, but it's not a good decision for us to spend money on it because it's so specialized. We only wish we could buy the computing engine from somebody.

Future . . .At MIT's Media Lab, I saw possibilities for three-dimensional representations of what we do. Imagine flying around a three-dimensional spreadsheet where if you saw a speck, you could enter it, and the speck becomes the next level. It's like a virtual environment of a conceptual space. Three-dimensional influence diagrams are the next level. Suppose we had world-class computer representations of decisions and world-class commitment of people actually doing those things to support it. We're talking about a transformation, and that's exciting.

Technology Transfer . . .One of my recent doctoral students won a major prize in management science and operations research for his thesis on sensitivity to relevance. It has to do with how big a mistake could you make if you didn't consider the interdependence of certain factors when making a decision. He presented it to SDG as part of our professional development activities. This research had been judged outstanding by the professional community, and it was going right to the people who could introduce it to their next client. It goes both ways because he was also an intern when he did this research and he saw the issues involved. It's like a teaching hospital. SDG has a strong academic program because we have strong applications for it. That's what makes it work.

Etc. . . .This isn't an ivory tower, and we know we can help people. When I teach, I want to be able to warranty that what I teach are at least twenty-year ideas. I want them to last a lifetime. Most of what I learned at MIT met that criterion. I want my students to help people make decisions about everything from investments to medicine, and not just to have a theory on how to help people. That's what I'm committed to-helping people.

![]()

Lawrence G. Roberts

President, ATM Systems

Lawrence G. Roberts (SB'59, SM'60, PhD'63) is president of ATM Systems of Foster City, California, a division of AMP's Connectware subsidiary. Between 1958 and 1963, he was a student technician, research assistant, and thesis student in RLE. Since graduation, Dr. Roberts has been involved in the development of the data communications industry, and is an architect of today's packet switching technology. At ARPA from 1967 to 1973, Dr. Roberts promoted the idea of networking computers with different hardware and software in order to share resources. He was responsible for the development of the ARPANET, the first major packet network. In 1973, Dr. Roberts founded Telenet, the first packet data communications carrier. He went on to become president and CEO of DHL Corporation, where he created NetExpress, Inc., and served as its chairman and CEO from 1983 to 1993.

Memories . . .I came to MIT in 1955 as an undergraduate. While staying on for my doctorate, I became involved in electronics and various research activities at RLE. I worked on the compression of photographs with Bill Schreiber, which was a hot topic. My thesis on the first hidden-line graphics developed the math for three-dimensional graphics, but I switched to communications after a few years. I also worked on the TX-2 with Tom Stockham (SB'55, SM'56, ScD'59), doing an analysis of the wave function needed to do a transform for the speakers that Amar Bose (SB/SM'52, ScD'56) was designing.

In 1962, I had a conversation with Lick [J.C.R. Licklider] and Corby [Fernando J. Corbat�]. Lick said a galactic network was needed where everyone could communicate and all the world's resources would be available, just like the Web. Lately, everyone is writing about the Internet and trying to reconstruct its past. It would be interesting to find Lick's memos, which were written in the early 1960s. Those memos are critical because Lick had the original idea, and he convinced me that it was important. After MIT, I went to the Advanced Research Projects Agency (ARPA) and started the ARPANET.

Beginnings . . .In 1973, I started Telenet, the first packet service for data. It went public in 1978 and was sold to GTE in 1979. Now it's Sprint Data Service and probably the world's largest data service. I went on to DHL for a year to get them out of start-up mode. In 1982, DHL started NetExpress, which built the technology to carry facsimile on data networks. They also had a data communications operation that ran a facsimile service, where we built one of the first asynchronous transfer mode (ATM) switches. In 1993, NetExpress was sold in pieces to AMP, CMC, and KDD. I was interested in the ATM part, which AMP had bought. Their Connectware subsidiary was created for AMP's communications activities, and ATM Systems is a division of Connectware, which is where I am today.

Issues . . .From my discussions with Lick, it was clear that there was a gap between computerized communication technologies and communications for computers. The question was how to combine them effectively and intelligently. As packet switching developed for computer communications, things changed dramatically. While we were developing that market for government, I also saw a commercial market. No one pursued it because they thought it was totally incompatible since it involved packets, not circuits. Now, everything is packets, and ATM is simply little packets that handle everything. We're now building the second generation of ATM switches.

There was a period when everyone's ATMs moved data, but they didn't think about solving several critical problems. It wasn't desirable to do what everyone else was doing because when we built a switch, we had to make it work. So, we had to solve some key problems, and I knew what those were because I had been in this field for thirty years. Once, after speaking to Dave Clark at MIT's Laboratory for Computer Science, I concluded that we needed weighted fair queuing to ensure quality of service, so I designed chips to do that. It meant that we could guarantee both delay and bandwidth. No other ATM switches can do that. Now, we're years ahead of everyone in developing a switch that will work and manage quality of service.

We also had a big hole in the technology that wasn't there for low-speed packet switching. With earlier packet technologies, like X.25, we had flow control, but with ATM, we didn't. So, either we added flow control to ATM or we had to depend on TCP (transmission control protocol), which is much too slow for ATM speeds. I started by designing a new, very low delay flow control for ATM called explicit rate, and submitted it to The ATM Forum. After two years it was accepted as the standard. At the same time, I've been adding it into our chips; laying out the chip design and the detailed code. The company is structured so that I don't have to spend all my time in administration. I can worry about the technology and make sure that it's right.

Our primary concern is getting our products out on time because custom chips always take longer than you think. In terms of switching, 90 percent of the logic is in the chip. Maybe half the work is software, but almost all the functionality is in the chip. For example, in weighted correct queuing, a single chip that does 256 cues must do 190 million additions per second. It's a large number of megaflops that do the computations, and it's all done inside the chip. We use VHDL code for greater design speed. When things are essentially operating at a cell per microsecond (700 nanoseconds for each cell), you must do a lot of computation in that time.

Some other companies won't even touch a chip. But we're at a point now where, if you're not doing chips and you don't have proprietary technology, you won't have a product. All the technology is in doing the chips. It's expensive and they take a long time, but that's an advantage. If it was easy, everybody would be doing it.

Obstacles . . .There's always a debate about whether people can do technical work and manage at the same time. Venture capitalists don't like it. They're afraid that if you're a technical person, you won't manage properly. It's a strong attitude that hurts industry. But, it turns out, if you know what you're doing, you can manage better than anybody.